Tax Department & Punjab Police Nab GST Fraudster for Fake ITC

Warns; such fraudulent activities will be met with full force of law

Chandigarh, February 18 : In a major breakthrough, the Punjab Excise and Taxation department, in a joint operation with the Fatehgarh Sahib Police, has successfully apprehended a GST fraudster for ingenuine ITC claimed by him amounting to Rs.3.65 Crore.

Show Cause Notice to GST Fraudster

Punjab Finance Minister Harpal Singh Cheema revealed that on January 25, 2023, the Deputy Commissioner State Tax, Ludhiana, issued a show cause notice under section 74 of the Act to accused Deepak Sharma for ingenuine ITC claimed amounting to Rs. 3.65 Crore. However, he neither deposited the tax nor submitted any reply. Consequently, on June 13, 2023, the adjudicating authority passed an order under the Act, creating a demand of Rs. 11.75 Crore, including Rs. 4.45 crore as interest and Rs. 3.65 crore as a penalty, as stated by Cheema.

Investigation and Bank Action

An investigation by TIU and Sales Tax Officers found that Deepak Sharma submitted a forged GST Registration Certificate to a bank. The bank froze the account at the request of Sale Tax Officer Fatehgarh Sahib, which received a recovery notice for Rs. 26 lakhs.

Special Task Force Operation

A special task force, formed by the SGST Department based on meticulous intelligence gathered over several weeks, conducted simultaneous raids with the Fatehgarh Sahib police at various locations linked to the accused.

Ongoing Investigations and Firm Action

Authorities are currently identifying and pursuing all entities involved in this fraud, having registered an FIR. Further investigations are underway to determine the total extent of the fraud and recover the evaded taxes.

Government’s Response and Warning

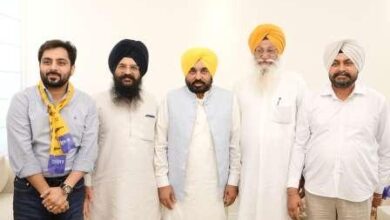

Finance Minister Cheema underscored Chief Minister Bhagwant Singh Mann’s Punjab government’s determination in combating GST fraud. He reiterated the government’s zero-tolerance stance against tax evasion and warned of stringent legal consequences for such fraudulent activities.