माधोपुर हैडवर्क्स बाढ़: पंजाब सरकार की बड़ी कार्रवाई, एक्सईएन समेत 3 अफसर सस्पेंड

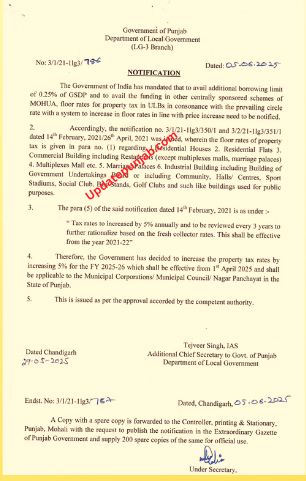

The Punjab Government has decided to increase the property tax by 5% with effect from April 1, 2025. The Local Government Department has issued a notification in this regard.

The revised tax will apply to residential and commercial buildings under all Municipal Corporations, Municipal Councils, and Nagar Panchayats in Punjab.

Earlier notification, the property tax is to be increased by 5% every year

As per an earlier notification dated February 14, 2021, the property tax is to be increased by 5% every year. Additionally, the tax rates will be reviewed every three years based on the updated collector rates.This step aims to increase the state’s borrowing limit and meet financial requirements.

govt of india has mandated that to avail additional borrowing limit of 0.25 percent

According to the latest notification, the govt of india has mandated that to avail additional borrowing limit of 0.25 percent of GSDP and avail the funding of other centrally sponsored schemes of MOHUA, floor rate of property tax in ULB in consonance with the prevailing circle rate with a system to increase in floor rates in line with price increase need to be notified